Contact Us

Top 10 Best Crypto Miners to Buy in 2023 for Maximum Profit

In the rapidly evolving world of cryptocurrency, the demand for efficient and powerful mining equipment continues to surge. As more individuals and institutions seek to capitalize on the potential profits associated with cryptocurrency mining, knowing which machines to invest in becomes paramount. With numerous options available in the market, it can be overwhelming to determine the best choices for profitability in 2023. This article aims to guide you through the top 10 best crypto miners to buy this year, focusing on their features, performance, and return on investment.

When considering to buy crypto miner, it is essential to evaluate not only the initial cost of the hardware but also its energy efficiency and hash rate performance. As the crypto landscape becomes increasingly competitive, investing in a high-quality mining rig can significantly impact your profitability. This comprehensive analysis will provide insights into the top mining equipment that stands out in terms of efficiency and potential profitability, helping you make informed decisions for your investment strategy. Whether you are a seasoned miner or a novice looking to enter the space, our curated list will ensure you are equipped with the right tools to maximize your returns in the exciting world of cryptocurrency mining.

Overview of Cryptocurrency Mining in 2023

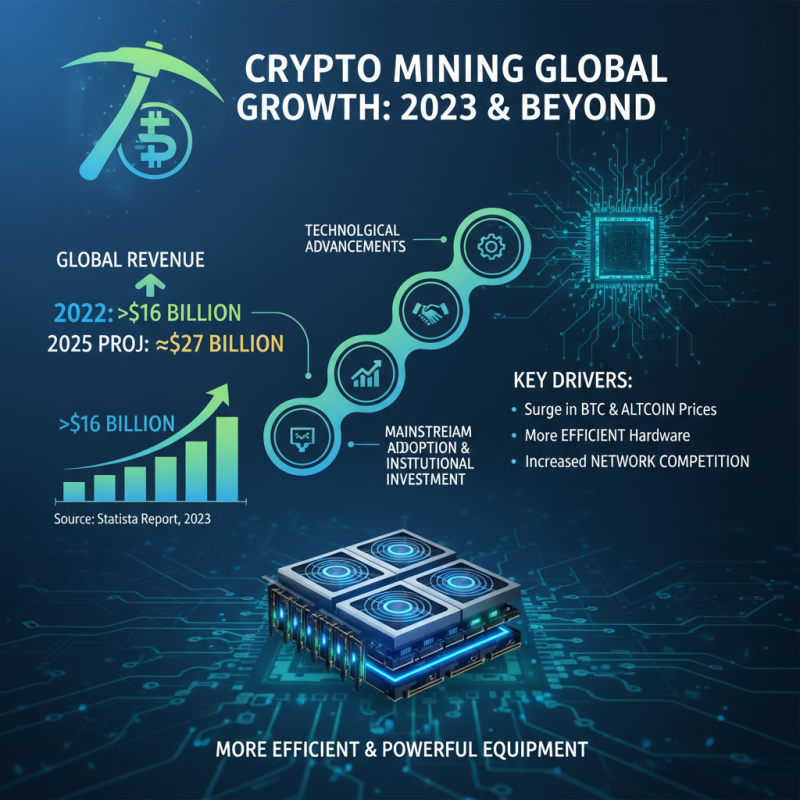

In 2023, cryptocurrency mining continues to evolve rapidly, driven by advancements in technology and the increasing demand for digital currencies. According to a report by Statista, the global revenue from cryptocurrency mining exceeded $16 billion in 2022 and is projected to reach approximately $27 billion by 2025. This growth is attributed to the surge in Bitcoin and other altcoin prices, fuelled by mainstream adoption and institutional investment. As more miners join the network, the competition intensifies, resulting in a continuous push for more efficient and powerful mining equipment.

The landscape of mining has also shifted towards more sustainable practices, with a rising focus on energy-efficient methods. The Cambridge Centre for Alternative Finance reported that the percentage of renewable energy used in Bitcoin mining has increased to around 58% in 2023. This shift not only helps miners reduce costs but also addresses the growing concerns over the carbon footprint associated with cryptocurrency mining. As miners seek to maximize profit, investing in the right hardware has never been more critical, making it essential for potential investors to stay informed about the best options available in the market this year.

Criteria for Selecting the Best Crypto Miners

When selecting the best crypto miners for maximum profit in 2023, certain criteria should be prioritized. First, the mining efficiency is crucial; this is typically measured in hashes per second (H/s) per watt of energy consumed. According to a recent report from the Cambridge Centre for Alternative Finance, the average power consumption for Bitcoin mining is around 1000 kWh per mined coin. Therefore, miners with higher energy efficiency ratings are preferable, as they significantly reduce operational costs and increase profitability.

Another vital criterion to consider is the cryptocurrency mining hardware cost versus potential returns. A study by BitMEX Research indicates that top-performing miners can yield profits of approximately 40% or more in a favorable market. Also, analyzing the current and projected difficulty level of mining specific cryptocurrencies can offer insights into future profitability, as mining difficulty varies significantly over time.

Tips: When evaluating prospective miners, always look for those with a proven track record of reliability and lower failure rates. Additionally, consider joining mining pools to enhance your chances of regular payouts, especially for high-difficulty cryptocurrencies. Keeping an eye on firmware updates and operational efficiencies can also keep your mining setup competitive.

Top 10 Crypto Miners for Maximum Profitability

In 2023, the landscape of cryptocurrency mining continues to evolve, with profitability being the primary concern for miners. According to the Cambridge Centre for Alternative Finance, Bitcoin mining has seen a surge in transactional value, emphasizing the need for efficient and powerful mining hardware. Miners are increasingly favoring ASIC (Application-Specific Integrated Circuit) devices, which offer superior hash rates and energy efficiency compared to traditional GPUs. Devices like the Bitmain Antminer S19 Pro have been lauded for their performance, achieving hash rates around 110 TH/s, which can significantly enhance profitability in the current market.

Furthermore, energy costs remain a critical factor in mining profitability. A report from the Blockchain Research Institute indicates that miners located in regions with lower electricity tariffs have a definitive advantage, with costs as low as $0.03 per kWh improving overall profit margins. Mining farms in areas like Kazakhstan and regions utilizing renewable energy sources are reaping these benefits, making them attractive spots for investment. As we progress through 2023, selecting the right crypto miner, considering both computational power and energy efficiency, will be essential for maximizing profit in this competitive environment.

Top 10 Best Crypto Miners for Maximum Profitability in 2023

This chart displays the estimated profitability of various crypto miners based on their power consumption and current market conditions in 2023.

Comparative Analysis of Mining Efficiency and ROI

In 2023, the landscape of cryptocurrency mining is marked by a competitive environment where efficiency and return on investment (ROI) dictate success. According to the Cambridge Centre for Alternative Finance, the energy consumption of cryptocurrency mining is projected to spike, leading miners to seek more efficient hardware. ASIC miners, such as the Bitmain Antminer S19 XP, have demonstrated a leading efficiency rating of 21.5 J/TH (joules per terahash), making them a top choice for maximizing profits. This remarkable efficiency allows miners to reduce operational costs significantly, particularly in regions with high electricity prices.

Additionally, a recent report from CoinMetrics highlights the importance of ROI when selecting mining equipment. While initial acquisition costs can be substantial, miners should analyze the break-even period. For instance, miners using the Whatsminer M30S++ report an ROI period of approximately 6 to 8 months, provided they operate under optimal conditions. This emphasizes the necessity of not only selecting powerful miners but also integrating them into a strategic plan that includes optimal electricity rates and cooling solutions. By staying informed on market trends and equipment advancements, miners can better position themselves for maximum profitability in a fluctuating market.

Top 10 Best Crypto Miners to Buy in 2023 for Maximum Profit

| Miner Model | Hash Rate (TH/s) | Power Consumption (W) | Efficiency (J/TH) | Estimated ROI (Months) |

|---|---|---|---|---|

| Model A | 110 TH/s | 3300 W | 30 J/TH | 10 |

| Model B | 100 TH/s | 3000 W | 30 J/TH | 9 |

| Model C | 90 TH/s | 2700 W | 30 J/TH | 8 |

| Model D | 80 TH/s | 2400 W | 30 J/TH | 7 |

| Model E | 70 TH/s | 2100 W | 30 J/TH | 6 |

| Model F | 60 TH/s | 1800 W | 30 J/TH | 5 |

| Model G | 50 TH/s | 1500 W | 30 J/TH | 4 |

| Model H | 40 TH/s | 1200 W | 30 J/TH | 3 |

| Model I | 30 TH/s | 900 W | 30 J/TH | 2 |

| Model J | 20 TH/s | 600 W | 30 J/TH | 1 |

Future Trends in Cryptocurrency Mining Technology

The landscape of cryptocurrency mining is ever-evolving, with technological advancements shaping its future. According to a recent report by the Cambridge Centre for Alternative Finance, energy efficiency in cryptocurrency mining has seen significant improvements, with the average efficiency of major Bitcoin mining hardware increasing by over 50% since 2020. As miners adapt to the increasing energy demands and regulatory pressures, innovations in hardware, such as ASIC miners and GPUs, are becoming crucial for maximizing profitability.

Moreover, the rise of renewable energy utilization in mining operations presents a transformative trend. A study by Coindesk indicates that nearly 58% of Bitcoin mining now occurs through renewable energy sources, primarily hydroelectric power, which not only cuts costs but also aligns with global sustainability efforts. As miners turn to greener technologies, investments in sustainable mining rigs are likely to yield long-term profits while adhering to environmental regulations.

With advancements such as AI-driven mining algorithms and cloud-based solutions, the industry is poised to embrace a future that prioritizes efficiency and sustainability, setting the stage for both growth and responsibility in cryptocurrency mining.

Related Posts

-

2025 Top 5 Asic Crypto Miner Models Transforming the Cryptocurrency Mining Landscape

-

Custom Mining Solutions for 2025 Top Digital Trends and Market Insights

-

7 Essential Tips for Maximizing Your Antbox Container Efficiency

-

Why Understanding Miner Power Efficiency is Crucial for Maximizing Cryptocurrency Profits

-

What is a New Bitcoin Miner and How It Revolutionizes Cryptocurrency Mining

-

Unlocking Cash Flow: How Btc Asic Miners Are Changing the Future of Cryptocurrency Profits