Contact Us

Best Crypto Mining Rigs For Sale 2026 Which One to Choose?

In 2026, the demand for crypto mining rigs for sale continues to grow. This surge reflects the increasing interest in cryptocurrency. With numerous options available, choosing the right rig can be challenging.

Potential buyers should consider several factors. Performance, efficiency, and cost are crucial. A powerful rig can yield better results. However, a high price doesn't always guarantee success. The market is flooded with choices. It's essential to find the right balance.

Investing in mining equipment is a significant decision. Some rigs perform well but can be expensive to run. Others are budget-friendly but may lack efficiency. Reflect on your needs. Do you want to mine for profit or as a hobby? Understanding what you want can simplify the selection process.

Overview of Crypto Mining Rigs Available in 2026

In 2026, the landscape of crypto mining rigs is evolving rapidly. Many options are now available, catering to various needs and budgets. The advancements in technology have led to more efficient rigs. They consume less energy while providing better hashing power. This is crucial in a competitive market. Speed and efficiency may decide your success.

However, the choice can be overwhelming. You may find rigs with high initial costs but better long-term gains. Some economical models are available, yet they might underperform. Also, consider the noise levels and cooling requirements. A more powerful rig might be noisier, impacting your work environment. Researching user reviews can help, but remember, individual experiences may vary.

Don't overlook the importance of support services. Reliable customer service can save you time and money. Sometimes, the cheapest option leads to future headaches. Balancing cost, performance, and durability is essential. In this crowded market, the right choice will greatly influence your success in mining activities. Explore all available details before making a decision.

Best Crypto Mining Rigs For Sale 2026

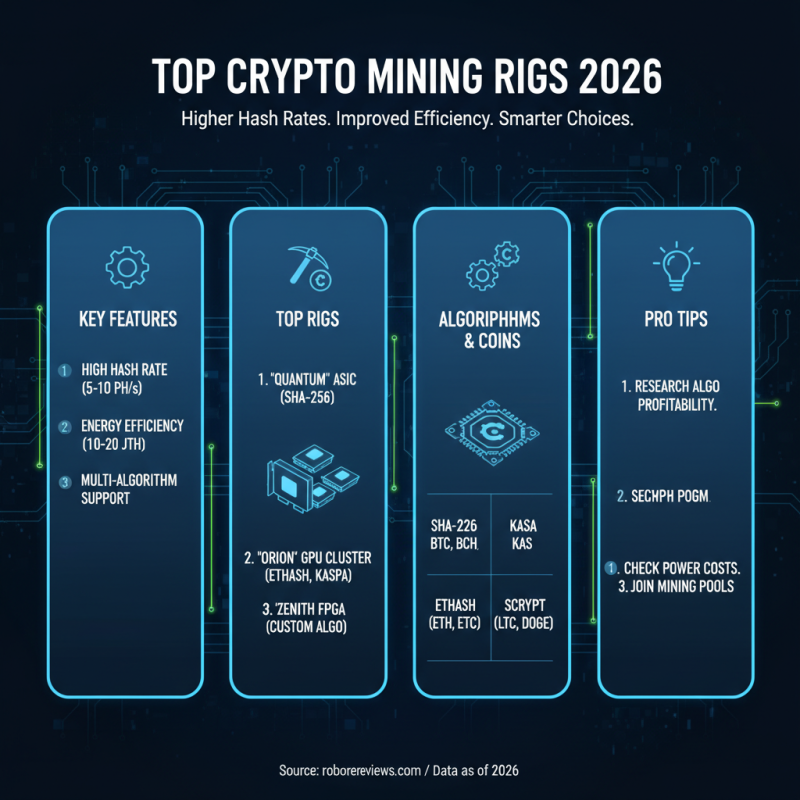

This chart illustrates the estimated hash rates and prices of various crypto mining rigs available in 2026. The data reflects the performance and investment required for each type of rig.

Factors to Consider When Choosing a Mining Rig

When choosing a mining rig, power efficiency is critical. Look for rigs that provide high hash rates with lower energy consumption. This balance can save you money on electricity bills. A good rig should ideally have a power supply unit that complements its performance needs.

Cooling systems also matter. Mining generates heat, which can affect your rig’s lifespan. Opt for rigs with effective cooling mechanisms, such as fans or liquid cooling options. This investment can prevent overheating and ensure consistent operation.

Budget is another factor to reflect on. Prices for mining rigs can vary significantly. Consider your budget, but don't skimp on quality. A more expensive rig may offer better longevity and returns. Always check reviews and consider the resale value too. Be mindful that not all rigs will yield the same performance over time. Some may have limitations that only become clear later.

Top Crypto Mining Rigs on the Market in 2026

When searching for the best crypto mining rigs on the market in 2026, you'll encounter a variety of options. These machines have advanced significantly. Many now offer higher hash rates and improved energy efficiency. Consider the mining algorithms you prefer. Not every rig works well with every coin.

Picking the right rig can be overwhelming. It's important to analyze your own needs. Think about your budget and power availability. Some rigs are powerful but consume a lot of electricity. This could reduce profits. Assess your mining goals carefully.

Tips: Pay attention to cooling systems. Efficient cooling prevents overheating and prolongs the rig's life. Investing in upgrades can also improve performance.

Another consideration is the assembly. Some rigs may require technical know-how. You may face challenges, especially if it's your first time. Do thorough research before committing to a specific model. A little extra effort now can save a lot of headaches later.

Performance Comparison: ASIC vs. GPU Mining Rigs

Choosing between ASIC and GPU mining rigs can be challenging. Both have distinct advantages. ASIC rigs offer superior hash rates. They are designed for specific algorithms. For example, many ASIC miners achieve hash rates over 100 TH/s, while some GPUs reach only about 30 MH/s. This stark difference often makes ASICs more efficient for Bitcoin mining.

However, GPU rigs provide flexibility. They can mine various cryptocurrencies. This adaptability is becoming important as market conditions shift. Reports indicate that GPUs still attract many miners due to their versatility. The graphics cards market has evolved, and some models are now quite powerful. Yet, they can consume more power. GPU rigs may require more cooling, increasing operational costs.

Tips: Always evaluate your electricity cost. This can drastically affect your earnings. Remember to ensure your setup is adequately ventilated. A silent rig might seem appealing, but noise often indicates heat issues. Making informed choices can minimize risks in crypto mining ventures. Balancing performance with cost is crucial.

Cost Analysis: Initial Investment vs. Potential Returns

When considering crypto mining rigs for sale in 2026, cost analysis is key. The initial investment can vary significantly. Prices for decent rigs might range from a few hundred to several thousand dollars. Assess your budget before diving in. Factor in the potential returns, too. Mining profitability depends on performance, electricity costs, and cryptocurrency prices.

Tips: Always keep an eye on energy consumption. It can eat into your profits. Look for rigs with efficient components. They might cost more upfront but save money long term. Remember that market conditions fluctuate. Be wary of price surges.

Another aspect to consider is maintenance. Some rigs may require more upkeep. This can mean extra costs. Durable rigs might offer better longevity, but they often have a higher price point. Reflect on trade-offs carefully. Can you afford downtime? Will it outweigh lower initial costs? These questions should guide your choice. Balancing all these factors is challenging yet essential.

Related Posts

-

Top 10 Best Crypto Miners to Buy in 2023 for Maximum Profit

-

Best GPUs for Bitcoin Mining in 2023 Top Choices for High Performance

-

Top 10 Factors to Consider When Choosing a Crypto ASIC Miner

-

How to Choose the Best Cryptocurrency Miners For Sale in 2025

-

Best Bitcoin Miner Store Reviews and Buying Guide?

-

Why Are Bitcoin Mining GPUs Essential for Cryptocurrency Mining?