Contact Us

Best Mining Rig for Maximum Profitability in Cryptocurrency 2023

In the ever-evolving world of cryptocurrency, the quest for the "Best Mining Rig" remains a pivotal concern for both novice and seasoned miners eager to maximize their profitability. According to leading cryptocurrency mining expert Dr. Alex Chen, "The right mining rig can significantly enhance your efficiency and returns, transforming your mining efforts into a profitable venture." As the digital currency landscape continues to shift with new technologies and algorithms, understanding the critical elements that contribute to a mining rig's performance is essential.

With advancements in hardware technology, miners must now consider not only the processing power of their rigs but also factors such as energy efficiency, cooling systems, and innovative designs that can enhance profitability. The competition is fierce, and having the most effective mining rig can make the difference between mere participation and substantial profitability in this dynamic market. Through careful selection and optimization of the "Best Mining Rig," individuals can better position themselves to navigate the complexities of cryptocurrency mining, ensuring they are equipped to capitalize on future opportunities.

Understanding Cryptocurrency Mining and Its Profitability Factors

Cryptocurrency mining is a complex process that not only requires technical knowledge but also an understanding of profitability factors that can significantly impact returns. Central to this is the choice of hardware. In 2023, ASIC miners continue to dominate due to their efficiency in terms of hash rate per watt. According to the latest industry reports, a well-chosen mining rig can yield monthly profits of up to 30%, depending on the cryptocurrency and market conditions. Additionally, the cost of electricity is a critical component of profitability; regions with lower energy prices can enhance returns significantly.

To maximize profitability, miners should monitor the difficulty level of the cryptocurrencies they are targeting. As more miners participate in the network, the mining difficulty increases, which can reduce profit margins. Tools like WhatToMine can provide real-time profitability calculators, giving insight into which coins to mine based on current metrics. Furthermore, staying updated on market trends and regulatory changes is vital, as these factors can greatly influence profitability.

Tips: When setting up a mining rig, invest in a high-quality power supply unit (PSU) and ensure adequate cooling to prevent overheating, which can decrease the lifespan of your components. Exploring mining pools can also enhance profitability by allowing miners to combine resources and share rewards, effectively smoothing out the income potential amidst fluctuating market conditions.

Types of Mining Rigs and Their Technical Specifications

When exploring the best mining rigs for maximum profitability in cryptocurrency in 2023, it’s essential to understand the various types of mining rigs available and their technical specifications.

Generally, mining rigs can be categorized into three main types:

ASIC miners,

GPU miners, and

FPGAs.

ASIC (Application-Specific Integrated Circuit) miners are designed for specific algorithms, resulting in significantly higher hashing power and energy efficiency. According to the latest industry data, ASIC rigs offer up to 45 TH/s (terahashes per second) for Bitcoin mining while consuming around 3250W, which presents a compelling advantage for miners seeking efficiency.

On the other hand, GPU (Graphics Processing Unit) mining rigs have become popular for mining multiple cryptocurrencies, particularly those based on algorithms more conducive to parallel processing. A typical GPU rig may consist of several high-end graphics cards, such as those capable of providing around 30 MH/s (megahashes per second) for Ethereum mining.

However, these setups require more energy per unit of hash power, often around 700W for similar outputs. The adaptability of GPU mining in a varied crypto landscape allows miners to switch between coins based on market conditions, which can enhance profit margins.

Lastly, FPGAs (Field-Programmable Gate Arrays) present a middle ground between ASIC and GPU miners. They offer customizable performance and improved efficiency, with the capacity to reach hashing rates of 1.5 GH/s for certain algorithms while maintaining a lower power consumption of roughly 500W. This balance of flexibility and efficiency is appealing to many miners as they navigate the complexities of a volatile market. Understanding these technical specifications can empower miners to make informed decisions that align with their profitability goals.

Evaluating Energy Efficiency and Cost Considerations

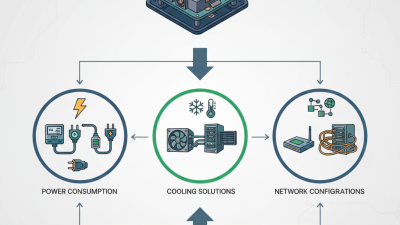

When considering the best mining rig for maximum profitability in cryptocurrency, energy efficiency and cost are paramount. A significant portion of mining expenses is attributed to electricity consumption. Thus, selecting hardware that offers high hash rates without excessive power draw can lead to considerable savings. Miners should analyze the power efficiency of their rigs, measuring the performance in terms of hash rate per watt. This ratio helps identify which equipment provides the best return on investment regarding energy consumption.

Tips: Always compare the electricity rates in your area before purchasing mining equipment. Consider investing in renewable energy sources, like solar panels, which can drastically reduce your long-term costs and improve overall profitability.

Additionally, it's essential to factor in the cost of cooling systems, as mining rigs generate substantial heat and require adequate ventilation to maintain optimal performance. Efficient cooling not only preserves the longevity of the hardware but also prevents overheating, which can lead to higher failure rates and increased maintenance costs.

Tips: Implementing a well-planned cooling strategy, such as using fans or liquid cooling systems, can enhance energy efficiency. Regularly monitoring the temperatures can also help ensure that your mining operation runs smoothly without unnecessary expenses.

Best Mining Rig for Maximum Profitability in Cryptocurrency 2023 - Evaluating Energy Efficiency and Cost Considerations

| Mining Rig Model | Hash Rate (MH/s) | Power Consumption (W) | Energy Efficiency (J/MH) | Cost ($) | Estimated Monthly Profit ($) |

|---|---|---|---|---|---|

| Rig A | 100 | 500 | 5.0 | 1500 | 250 |

| Rig B | 120 | 600 | 5.0 | 1800 | 300 |

| Rig C | 150 | 650 | 4.33 | 2000 | 350 |

| Rig D | 80 | 400 | 5.0 | 1200 | 200 |

| Rig E | 110 | 500 | 4.55 | 1700 | 280 |

Identifying the Most Profitable Cryptocurrencies for Mining

When considering the most profitable cryptocurrencies for mining in 2023, it's essential to focus on the ones that demonstrate strong growth potential and are still accessible for miners. While Bitcoin continues to dominate the market, the high difficulty level and energy consumption make it less appealing for individual miners. Instead, cryptocurrencies like Ethereum Classic or Ravencoin have emerged as viable alternatives, offering substantial rewards with lower competition and energy requirements.

Tips: Always conduct thorough research on emerging coins and monitor market trends to identify new opportunities. Additionally, consider joining mining pools, as they allow miners to combine resources and increase their chances of earning rewards, making mining less resource-intensive.

It's also crucial to stay updated on network changes and fork events that can impact mining profitability. Projects that are under the radar or in the developmental phase may yield higher returns compared to established currencies. Engaging with community forums and resources can provide valuable insights into which cryptocurrencies are gaining traction and could become the best bets for miners this year.

Tips: Keep an eye on the project's roadmap and community engagement, as these factors can play a significant role in the longevity and profitability of a cryptocurrency in the mining landscape.

Most Profitable Cryptocurrencies for Mining in 2023

This chart represents the estimated profitability of various cryptocurrencies for mining in 2023. The profitability is calculated based on factors such as mining difficulty, reward per block, and current market price.

Tips for Optimizing Mining Rig Performance and ROI

When it comes to optimizing mining rig performance and maximizing return on investment (ROI) in cryptocurrency, several key strategies come into play. First and foremost, ensuring that your hardware is properly configured is crucial. This includes fine-tuning the clock speeds and power settings for GPUs, as well as selecting the right mining software that complements your rig's capabilities. Regularly updating your drivers and software can also lead to better efficiency and stability, which in turn can enhance your mining output.

Another important aspect of optimizing mining performance is maintaining consistent and efficient cooling solutions. Overheated components can lead to reduced performance and even hardware damage. Utilizing high-quality cooling systems, such as fans or liquid cooling, can ensure that your rig operates within safe temperature ranges. Additionally, managing your mining environment, keeping dust away, and ensuring proper airflow can significantly reduce the chances of overheating and maximize uptime.

Finally, considering the electricity cost is vital for calculating mining profitability. Implementing energy-efficient practices by using energy meters to monitor consumption and experimenting with power-saving settings can substantially lower electricity bills. This, combined with exploring different mining pools that offer lower fees, can effectively enhance your overall ROI. By focusing on these optimization strategies, miners can maximize their profits while ensuring the longevity and performance of their rigs.

Related Posts

-

What is a New Bitcoin Miner and How It Revolutionizes Cryptocurrency Mining

-

Ultimate Guide to Asic Mining Rig Setup Tips and Best Practices

-

How to Choose the Best Asic Mining Shop for Your Cryptocurrency Needs

-

Best GPUs for Bitcoin Mining in 2023 Top Choices for High Performance

-

7 Essential Tips for Maximizing Your Antbox Container Efficiency

-

Custom Mining Solutions for 2025 Top Digital Trends and Market Insights