Contact Us

Btc Container Tips for Securely Storing Your Cryptocurrency Assets

Storing cryptocurrency securely is of utmost importance. With the rise of digital assets, the need for a reliable storage solution has become essential. One popular method is using a BTC container. These containers provide a secure way to store your Bitcoin and other cryptocurrencies.

When choosing a BTC container, think carefully about its features. Not all containers are created equal. Some offer advanced security features, while others may lack basic protections. It is vital to understand your specific needs when selecting a container.

Mistakes can happen if you rush through the process. Many users overlook essential details, such as backup options. Consider how accessible your assets need to be. Rethink your approach if you feel uncertain. A secure BTC container can protect your investments, but only if chosen wisely.

Understanding Cryptocurrency Storage: An Overview of BTC Containers

When it comes to cryptocurrency storage, understanding BTC containers is crucial. According to a recent report, around 20% of all Bitcoin is believed to be lost due to poor storage practices. This highlights the need for secure methods to store digital assets. BTC containers, like hardware wallets, provide protection against hacking and unauthorized access. They store private keys offline, significantly reducing risks.

Not all containers are created equal. A survey indicated that more than 50% of cryptocurrency holders do not utilize secure storage solutions. Many still keep their assets on exchanges, exposing themselves to potential hacks. Users should prioritize understanding their options. Cold storage is a preferred choice. However, it isn’t perfect. There are risks. If you lose the device or forget the PIN, recovery can be impossible.

Education is a vital part of securely storing assets. Familiarizing oneself with the features of different BTC containers is necessary. An informed choice can prevent costly mistakes. Cybersecurity measures are evolving, and so should storage practices. Finding a balance between accessibility and security is key. Always assess the trade-offs.

Btc Container Tips for Securely Storing Your Cryptocurrency Assets

This bar chart illustrates the various methods of securely storing Bitcoin (BTC) assets, highlighting their effectiveness and prevalence among cryptocurrency users.

Types of BTC Containers: Hardware, Software, and Paper Wallets Explained

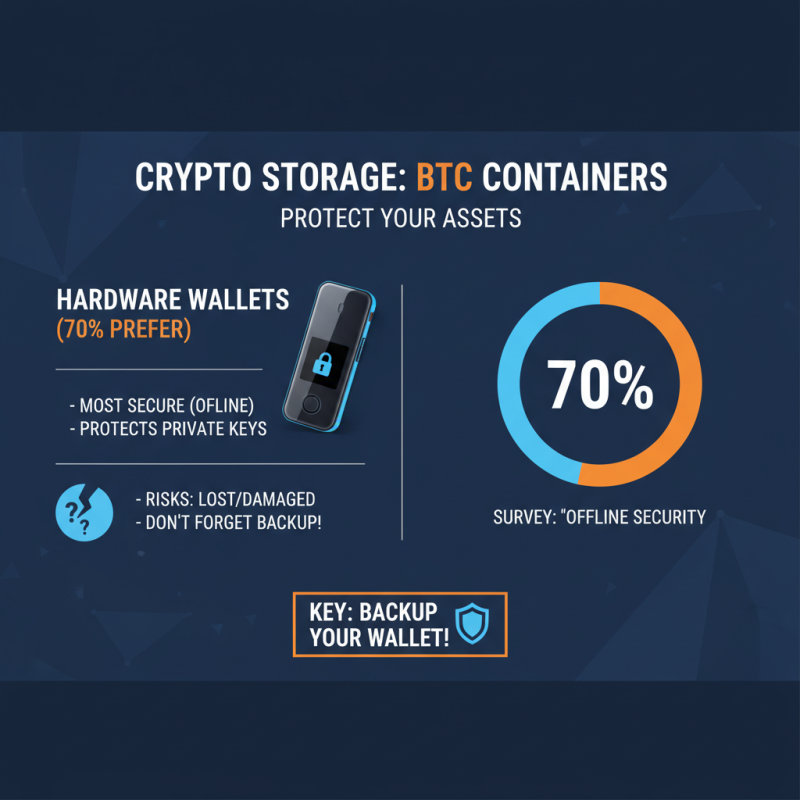

When it comes to storing your cryptocurrency, understanding the types of BTC containers is crucial. Hardware wallets are regarded as the most secure option. According to a survey by the Crypto Wallet Security Report, about 70% of crypto holders prefer hardware wallets due to their offline nature. These devices protect private keys from online threats, but they can be lost or damaged. Users often overlook the importance of backing up their wallets, which can lead to permanent loss of access.

Software wallets offer a different approach. They provide convenience but come with risks. A 2021 analysis revealed that 45% of software wallets experienced security breaches. They are usually easier to use and suitable for daily transactions. Yet, users should exercise caution. Regular updates and strong passwords are vital. Simple mistakes can compromise your assets.

Lastly, paper wallets stand out due to their simplicity. They involve printing your keys and storing them safely. However, they are not foolproof. A well-known risk is physical damage. Fire or water can easily ruin a paper wallet. Many users fail to consider such vulnerabilities. A comprehensive understanding of these container types is essential for effective cryptocurrency management.

Best Practices for Securing Your Cryptocurrency Assets in Containers

Storing cryptocurrency securely is vital. Reports indicate that nearly 70% of cryptocurrencies are held in exchanges, which are often vulnerable to hacks. Many users overlook the importance of secure storage solutions. Employing hardware wallets or secure containers provides a safety net against potential losses.

Choosing the right container is crucial. Opt for hardware wallets that encrypt private keys. These wallets are not connected to the internet, reducing the risk of unauthorized access. A 2021 study found that users who rely on hardware wallets face 50% fewer hacking incidents than those using online options. Regular software updates also play a key role. They protect against emerging vulnerabilities.

Many individuals underestimate the impact of physical security. Secure containers should be stored in safe locations. Regularly check the integrity of these containers. Small lapses may lead to severe consequences. A comprehensive approach includes both digital and physical measures. Reflect on your security practices. Are they robust enough? Regular reviews can make a difference.

Tips for Choosing the Right BTC Container for Your Needs

When it comes to securely storing cryptocurrency, choosing the right BTC container is crucial. Many users opt for hardware wallets due to their enhanced security features. Research by Cybersecurity Ventures indicates that cybercrime damages will cost the world $10.5 trillion annually by 2025. This sobering statistic urges cryptocurrency holders to reevaluate their storage methods.

Consider a hardware wallet with multiple security layers. Look for features like a secure element chip. This chip safeguards your private keys from unauthorized access. Additionally, ensure the device supports the coins you own. Token support can vary widely among wallets. Some wallets may lack updates or compatibility with new currencies.

Software wallets are another option. They provide convenience but carry risks. According to a survey by Fortune Business Insights, the global digital wallet market was valued at $1.63 trillion in 2021 and is expected to grow significantly. However, this growth is accompanied by increased phishing attacks. Hence, always be cautious when selecting a software wallet. Review user feedback and search for common vulnerabilities. Balancing security and usability is essential. Each choice, whether hardware or software, has its trade-offs, making vigilance vital in safeguarding assets.

Maintaining and Updating Your BTC Container for Maximum Security

To enhance the security of your BTC container, regular maintenance is essential. Make it a habit to update software and firmware regularly. Outdated systems can expose vulnerabilities. Set reminders for these updates, ensuring they are not overlooked.

Here are some tips for maintaining your BTC container. Always use strong, unique passwords for your wallets. Consider using a password manager to keep track. Enable two-factor authentication whenever possible. This adds an extra layer of security.

Physical security matters too. Store your hardware container in a safe location. Avoid places that are easily accessible to others. Regularly check for signs of tampering or damage. These checks can reveal potential security risks. Reflect on your storage habits often to improve them. Sloppy practices can lead to vulnerabilities you might miss. Stay vigilant, as the world of cryptocurrency evolves quickly.

Related Posts

-

How to Choose the Best Asic Mining Shop for Your Cryptocurrency Needs

-

Top 10 Factors to Consider When Choosing a Crypto ASIC Miner

-

How to Optimize Your Mobile Mining Unit for Maximum Efficiency in 2025

-

What is a New Bitcoin Miner and How It Revolutionizes Cryptocurrency Mining

-

What is a Bitmain Container and How Does It Work for Mining?

-

2025 Top 5 Asic Crypto Miner Models Transforming the Cryptocurrency Mining Landscape