Contact Us

Top 10 Factors to Consider When Choosing a Crypto ASIC Miner

When venturing into the world of cryptocurrency mining, selecting the right hardware is paramount to maximizing profitability and efficiency. Among the various options available, a Crypto ASIC Miner stands out as a preferred choice for serious miners due to its specialized design tailored for a specific algorithm. Unlike general-purpose hardware, ASIC miners offer unparalleled processing power and energy efficiency, enabling miners to tackle complex computations with remarkable speed. However, before making a purchase, there are several critical factors that potential buyers must consider to ensure they are making an informed decision.

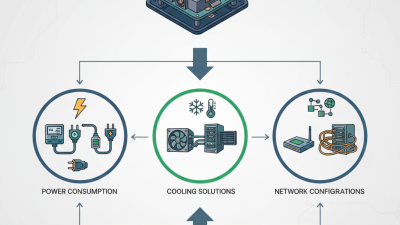

The landscape of cryptocurrency mining is constantly evolving, and the choices available can be overwhelming. Factors such as hash rate, energy consumption, cooling solutions, and initial cost are just a few of the elements that can influence the performance and ROI of a Crypto ASIC Miner. By understanding these key considerations, miners can position themselves for success and navigate the challenges inherent in this competitive environment. In the following sections, we will delve into the top 10 factors that should guide your selection process, empowering you to choose a Crypto ASIC Miner that best aligns with your mining goals and operational needs.

Understanding ASIC Miners: A Beginner's Guide

ASIC miners, or Application-Specific Integrated Circuit miners, are specialized devices designed specifically for cryptocurrency mining. Unlike general-purpose hardware like CPUs or GPUs, ASICs are optimized for high efficiency and performance in solving the cryptographic puzzles required for mining operations. According to industry reports, ASIC miners can achieve hash rates in the terahash per second (TH/s) range, significantly outperforming traditional mining hardware.

When starting in the world of cryptocurrency mining, it's essential to understand the factors that contribute to a successful mining operation. One crucial aspect to consider is energy consumption. Reports indicate that energy usage is one of the primary costs associated with mining, with efficient ASIC miners capable of providing a better hash rate-to-power ratio. Miners should assess both the power consumption of the device and local electricity costs to ensure profitability.

Tips: Always look for mining efficiency metrics such as Joules per Terahash (J/TH) to evaluate a miner's performance. Additionally, joining mining pools can help beginners share resources and reduce the risks associated with individual mining. By understanding these fundamental aspects, novice miners can make informed decisions and maximize their returns in the cryptocurrency mining landscape.

Evaluating Hash Rate and Mining Efficiency

When evaluating the hash rate and mining efficiency of a Crypto ASIC miner, the first aspect to consider is the hash rate itself. This metric indicates how many hashes per second the miner can compute, directly influencing the likelihood of successfully mining new blocks. A higher hash rate generally translates into increased earning potential, as it enhances the miner’s chances of solving complex cryptographic puzzles faster than others in the network. However, hash rates are not the sole determining factor; miners must also consider the relationship between hash rate and energy consumption.

Mining efficiency, typically expressed as the number of hashes generated per unit of power consumed, is crucial in assessing the overall profitability of a mining operation. Miners should look for devices that maintain a high hash rate while minimizing energy costs, as electricity can significantly impact profit margins. By balancing a high hash rate with low energy consumption, miners can ensure that their operations remain sustainable and economically viable in the long term. Ultimately, blending these two factors—hash rate and mining efficiency—will help miners make informed decisions that align with their financial goals and operational capacities.

| Model | Hash Rate (TH/s) | Power Consumption (W) | Efficiency (J/TH) | Price (USD) | Availability |

|---|---|---|---|---|---|

| Model A | 100 | 3500 | 35 | 2000 | In Stock |

| Model B | 90 | 3250 | 36.1 | 1800 | Limited Stock |

| Model C | 110 | 3900 | 35.45 | 2200 | In Stock |

| Model D | 85 | 3000 | 35.29 | 1600 | Out of Stock |

| Model E | 120 | 4200 | 35 | 2400 | In Stock |

| Model F | 75 | 2500 | 33.33 | 1400 | Limited Stock |

Assessing Energy Consumption and Operating Costs

When selecting a crypto ASIC miner, understanding the energy consumption and operating costs is paramount. The efficiency of the miner significantly impacts its profitability. ASIC miners consume substantial amounts of electricity, and the cost of energy varies widely based on location and provider. Prospective miners must calculate the energy consumption in watts and compare it to the current electricity rates in their area. This variation can drastically affect overall operational costs and should be a critical factor in the decision-making process.

Moreover, beyond just energy costs, one must also consider the cooling requirements due to heat generated during mining. High-performance ASIC miners often require additional cooling systems to maintain optimal operating temperatures, which can further increase electricity consumption and costs. Calculating the total cost of ownership, which includes electricity costs, cooling requirements, and potential maintenance expenses, will provide a clearer picture of the long-term viability of the mining operation. Balancing the initial investment with the ongoing expenses will ultimately determine the profitability of your mining endeavors.

Energy Consumption and Operating Costs of Top 5 Crypto ASIC Miners

Considering Brand Reputation and Customer Support

When choosing a crypto ASIC miner, brand reputation and customer support play crucial roles in your decision-making process. Opting for a reputable brand can ensure you're getting a product that has been tried and tested by other users in the market. Well-established brands usually have a track record of reliability, performance, and customer satisfaction. A strong reputation often correlates with quality assurance and ongoing product development, which can significantly benefit long-term miners.

Customer support is equally important. In the fast-paced world of cryptocurrency mining, issues can arise unexpectedly, and having access to responsive customer support can make a difference between a smooth experience and ongoing frustration. Look for brands that offer multiple channels of communication, such as live chat, email, and phone support. Additionally, check online reviews and forums to gain insights into the experiences of other users regarding the support services provided by the brand.

Tips: Before making your purchase, take the time to read user reviews and testimonials to gauge customer experiences. Furthermore, consider reaching out to customer service with any questions you may have; their response time and helpfulness can be indicators of the support you can expect post-purchase. Lastly, ensure that the brand offers warranties or guarantees, as this reflects their confidence in their products and commitment to customer satisfaction.

Exploring Compatibility with Mining Pools and Software

When choosing a crypto ASIC miner, one of the crucial considerations is its compatibility with various mining pools and software. Mining pools allow miners to combine their computational power, increasing the chances of successfully mining blocks and earning rewards. According to a recent report by CoinMetrics, over 60% of Bitcoin miners participate in mining pools to enhance their profitability. Therefore, it is essential to ensure that the ASIC miner you choose can seamlessly integrate with popular mining pools to maximize your earnings.

Moreover, optimally configuring the mining software is imperative for efficiency and performance. Leading mining software packages support a range of algorithms and mining strategies, allowing miners to adjust their settings for better results. A survey by the Cambridge Centre for Alternative Finance highlighted that miners using optimized software configurations could achieve up to 30% higher hash rates. Ensure that the ASIC miner you select is compatible with widely adopted software solutions, allowing for flexibility in managing your mining operations.

Tip: Always check the miner's documentation for a list of supported mining pools and software. This can save you time and potential headaches during setup, ensuring you can start mining without compatibility issues. Additionally, consider testing different pool configurations to find the most profitable combination based on current network conditions.

Related Posts

-

Ultimate Guide to Asic Mining Rig Setup Tips and Best Practices

-

Unlocking Cash Flow: How Btc Asic Miners Are Changing the Future of Cryptocurrency Profits

-

What is a New Bitcoin Miner and How It Revolutionizes Cryptocurrency Mining

-

What is a Bitmain Container and How Does It Work for Mining?

-

Top 10 Best Crypto Miners to Buy in 2023 for Maximum Profit

-

Why Understanding Miner Power Efficiency is Crucial for Maximizing Cryptocurrency Profits